The Dispute Management module within BankWise Technology's Happy Banker platform streamlines the handling of electronic transaction disputes, ensuring compliance with Regulation E (Reg E) while enhancing operational efficiency. It works seamlessly with FIS Horizon® and also supports integration with other core banking systems for optimized dispute workflows.

The Dispute Management module within BankWise Technology's Happy Banker platform streamlines the handling of electronic transaction disputes, ensuring compliance with Regulation E (Reg E) while enhancing operational efficiency. It works seamlessly with FIS Horizon® and also supports integration with other core banking systems for optimized dispute workflows.

Key Features:

- Supports Multiple Dispute Types:

- Efficiently manage disputes related to Debit Card, ACH, and Zelle transactions, providing a comprehensive solution for electronic transaction dispute handling.

- Comprehensive Transaction Processing:

- Directly process transactions such as Provisional Credits and Charge Offs within the module.

- Automatic selection of appropriate General Ledger (GL) account types based on factors like account details, dispute type, and card BIN, ensuring accuracy and reducing manual effort.

- Automated Interest Calculation:

- Seamlessly retrieves the correct interest rate from the core banking system.

- Calculates precise interest amounts based on the duration since the dispute was reported, eliminating manual calculations and potential errors.

- Regulatory Compliance Support:

- Automated reminders to ensure adherence to Reg E timelines and requirements.

- Comprehensive tracking and documentation to support compliance audits and reporting.

- Correspondence Management:

- Generate documents based on customizable templates, ensuring consistency and efficiency in communications.

- Simplify the management of regulatory notices and customer correspondence by generating ready-to-send documents, reducing manual workload

Benefits:

- Operational Efficiency: By automating key aspects of dispute management, financial institutions can reduce processing times, minimize errors, and allocate resources more effectively.

- Improved Customer Experience: Efficient and accurate dispute resolution enhances customer satisfaction and trust.

- Risk Mitigation: Comprehensive tracking and automated compliance features reduce the risk of regulatory penalties and operational losses.

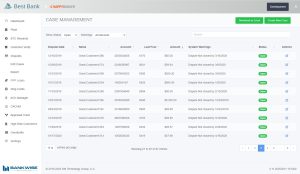

The Dispute Management module is a comprehensive solution designed to help financial institutions efficiently handle disputes related to electronic transactions, including ACH, Zelle, and debit card disputes. It supports Reg E compliance, dispute tracking, provisional credit processing, automated interest calculations, and correspondence management.

For more information or to schedule a demonstration, please contact us or schedule a demo today.